Syntec Optics Holdings, Inc. (Nasdaq: OPTX) Reports Full Year 2024 and First Half 2025 Financial Results

Adjusted EBITDA Grew to 15.3% in the First Half of 2025 Compared to 7.7% in Full-Year 2024, First Half 2025 Earnings per Share Rises to $0.00 from Negative $0.03 in 2024

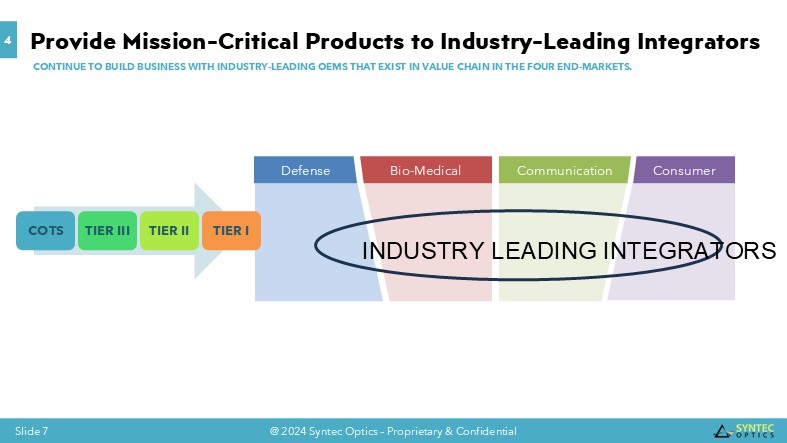

ROCHESTER, NEW YORK, Oct. 06, 2025 (GLOBE NEWSWIRE) -- Syntec Optics Holdings, Inc. (“Syntec Optics” or the “Company”) (Nasdaq: OPTX), a leading provider of mission-critical products to advanced technology defense, biomedical, and communications equipment & scientific instruments manufacturers, reported financial and operational results for the full year 2024 and first half 2025.

Full Year 2024 Financial Highlights

- Sales from products increase by $1.9 million year-over-year

- Adjusted EBITDA of $2.2 million was positive but down $3.1 million from the 2023 adjusted EBITDA of $5.3 million

- Cash, including available lines of credit, was nearly $5.1 million

First Half 2025 Financial Highlights

- Net Sales of $13.6 million, up $0.3 million from $13.3 million compared to 2024

- Adjusted EBITDA as a percentage of revenue increased to 15.3% for the six months ended June 30, 2025, compared to 5.8% for the same period in 2024

- Cash, including available lines of credit, was $4.3 million

- 8% of principal on commercial bank lines was paid down during the six months ended June 30, 2025

- Net income for the six-month period ending June 30, 2025, improved by $0.9 million versus the same period in 2024

Operational and Business Highlights

- Entered a new end-market - Energy - by enabling light for space-based solar power and grid-scale fusion energy products in the first half of 2025

- Strengthened the management team in the first part of 2025 for public markets

- Continued production on night vision goggles, integrated scope, and other aiming scope optics for defense in 2024 and the first half of 2025

- Continued production for disposable optics for biomedical diagnostics in 2024 and the first half of 2025

- Continued production for Low Earth Orbit Satellite Space Optics in 2024 and the first half of 2025

- Launched one new product in optical connectivity for Artificial Intelligence deployment-based scaling of data centers in 2024, and started production runs in the first half of 2025

- Initiated engineering that expands the space optics line of products into new products for complementary ground networks and satellite path tracking

The calendar year 2024 was marked by record-high Net Sales and growth within the new end-market – Communications, a double-digit increase. This includes sales for Space Optics and AI-driven Data Center optical connectivity.

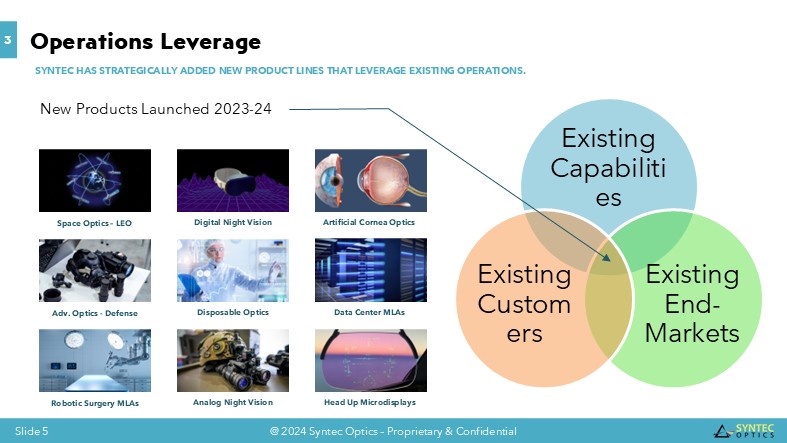

Syntec Optics leveraged a robust platform and continued to innovate, offering products for existing markets and utilizing existing capabilities to serve existing customers. Space Optics reached higher production levels. Next, low-weight hybrid optics used in night vision goggle systems are finalizing volume production OEM acceptances. Production ramp occurs after the product is produced on a higher volume line, meets customer specifications, and is integrated into the end product by the customer for final OEM acceptance.

Full Year 2024 Financial and Operating Results

Sales from products increase by $1.9 million year-over-year in the Net Sales of $28.4 million, reflecting strong gains in capacity utilization and robust product demand while moving from pilot plant to mass production on several major product lines.

Adjusted EBITDA of $2.2 million decreased from the 2023 adjusted EBITDA of $5.3 million, primarily driven by the decrease in net income resulting from the costs associated with the company’s transition and reorganizing for public markets, which the company believes can be reduced in the years to follow.

Specifically for the fourth quarter, we provided guidance at our last call that fourth-quarter revenue would exceed $7.4 million. Our actual revenue for the quarter was $7.3 million.

We are pleased to announce that in 2024, we invested $3.3 million in state-of-the-art equipment to enhance our capacity to reliably service our customers. These investments will enable us to continue developing our key technologies for our customers in 2025 and beyond.

First Half 2025 Financial and Operating Results

Sales for the six months ended June 30, 2025, totaled $13.6 million, an increase of $0.3 million from the same period in 2024. This growth was driven by increases in biomedical industry sales of $0.8 million and defense tech industry sales of $0.6 million.

Gross profit for the six months was $3.9 million, a $1.0 million improvement over 2024’s $2.9 million gross profit, moving our gross margin from 22% for the six months ending June 30, 2024, up to 29% for the six months ending June 30, 2025. Improvements across materials, labor, and manufacturing overhead all contributed to the improvements as the Company drives towards greater efficiencies. The company believes it will continue to improve gross profits as yields improve.

General and administrative expenses for the six months ending June 30, 2025, were $3.5M, a $0.6 million reduction from 2024. There were reductions of $0.4 million in outside consulting, $0.1 million in travel.

Adjusted EBITDA of $2.1 million increased by $1.2 million from the first half of the prior year, resulting in our adjusted EBITDA as a percentage of revenue rising from 5.8% in 2024 in the same period to 15.3% for the six months ended June 30, 2025, representing a significant improvement in profitability.

The Company ended the second quarter of 2025 with unused lines of credit totaling $1.5 million and $2.8 million, as well as a paydown of 8% principal on other commercial bank lines for the six months ended June 30, 2025.

Net income for the six-month period ending June 30, 2025, of $0 million was an improvement of $0.9 million versus the same period in 2024, reflecting a $1.0 million improvement in gross profit and a $0.6 million reduction in general and administrative expenses, partially offset by increased interest and other expenses.

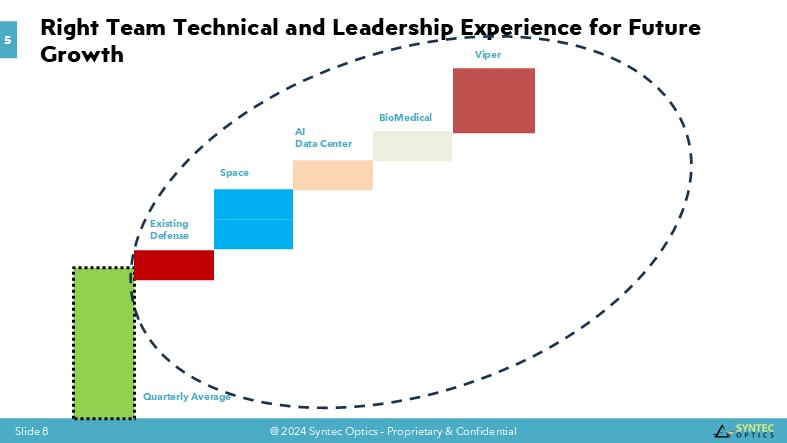

Future Growth

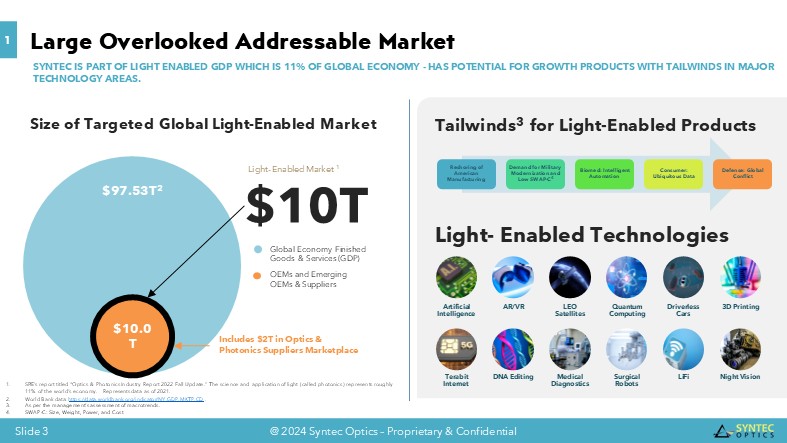

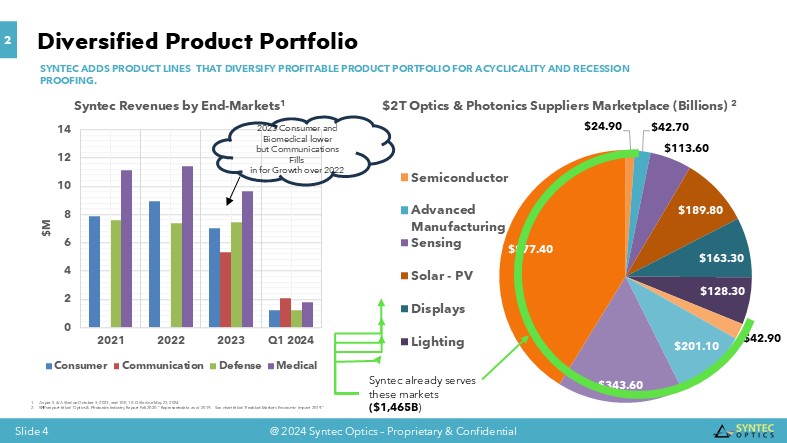

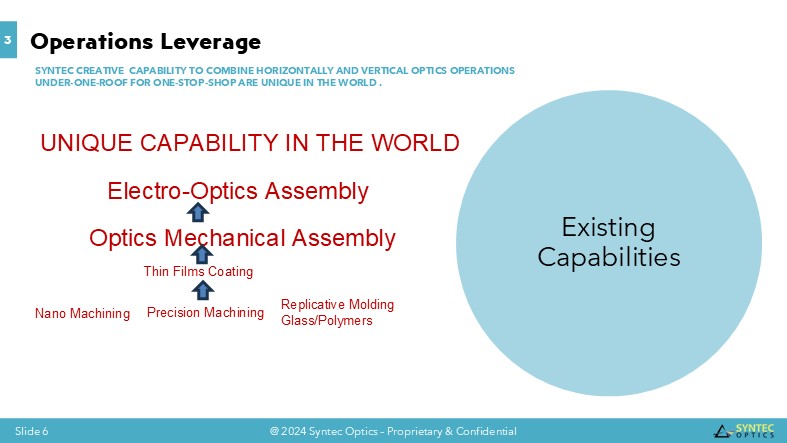

Syntec Optics’ strategy is to lead the large yet often overlooked market for light-enabled products by offering a diverse product portfolio tailored to the needs of blue-chip customers. This approach leverages our operational strengths, including the horizontal and vertical integration of optics manufacturing processes and techniques. We believe that, as more products become light-enabled, we will continue to have growth opportunities for many years to come. Here is how we are currently executing on our strategy.

We have implemented a clear, three-pronged execution plan that provides a roadmap for sustainable growth and involves everyone in the company, including technicians who design and manufacture the intricate optics. By focusing first on operational excellence, then scaling our talented team, and finally expanding into new, high-growth, light-enabled markets, we are positioning Syntec Optics to capitalize on the immense opportunities.

The Company’s execution plan is centered on the following three pillars:

1. Operational Excellence to Maximize Capacity: The first prong focuses on improving yield and maximizing capacity utilization to meet robust demand for our current products. All key customers are demanding increased volumes, in most cases, 20%, 50% to 100% higher than we are currently delivering. The Company is deploying enhanced operations KPIs, daily technician meetings (DTMs), and ERP dashboards to provide real-time data for decision-making. This initiative targets increased efficiency in key growth areas: LEO Satellite Optics (Communication), Aiming / Night Vision / Integrated Scopes Optics (Defense), Artificial Intelligence-driven Data Center Optics (Communication), and Hospital Diagnostic Optics (Biomedical). This execution builds upon our highly defensible model of vertical and horizontal integration.

2. Scaling Production with Increased Staffing: Second, simultaneously targeted yield improvements from 40%-50% in some cases to 95%, Syntec is increasing staffing on night shifts. This will allow the Company to continue scaling its production platforms, ensuring it can not only satisfy existing customer demand but also prepare for the next wave of growth from new and emerging applications.

3. Expansion into New Breakthrough Applications: The third prong centers on innovation and market expansion. As more products across end-markets become light-enabled, Syntec is securing new customers in breakthrough applications. Key new areas of delivering products include Fusion Energy (a new end-market), Hyperspectral Imaging (Defense), Ground Network for Satellite Communications (Space), and furthering Quantum Computing / DNA Sequencing, all simultaneously positioning the Company at the forefront of next-generation technology.

Syntec intends to codify this execution plan so that it can be applied to future inorganic growth through acquisitions.

About Syntec Optics

Syntec Optics Holdings, Inc. (Nasdaq: OPTX), headquartered in Rochester, NY, is one of the largest custom and diverse end-market optics and photonics manufacturers in the United States. Operating for over two decades, Syntec Optics runs a state-of-the-art facility with extensive core capabilities of various optics manufacturing processes, both horizontally and vertically integrated, to provide a competitive advantage for mission-critical OEMs. As more products become light-enabled, Syntec Optics continues to add more product lines, including recent Low Earth Orbit (LEO) satellite optics for communication, lightweight night vision goggle optics for defense, biomedical optics for defense, and data center optics for Artificial Intelligence. To learn more, visit www.syntecoptics.com.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, including certain financial forecasts and projections. All statements other than statements of historical fact contained in this press release, including statements as to the transactions contemplated by the business combination and related agreements, future results of operations and financial position, revenue and other metrics, planned products and services, business strategy and plans, objectives of management for future operations of Syntec Optics, market size, and growth opportunities, competitive position and technological and market trends, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,” “could,” “would,” “continue,” “forecast” or the negatives of these terms or variations of them or similar expressions. All forward-looking statements are subject to risks, uncertainties, and other factors (some of which are beyond the control of Syntec Optics), which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. All forward-looking statements are based upon estimates, forecasts and assumptions that, while considered reasonable by Syntec Optics and its management, as the case may be, are inherently uncertain and many factors may cause the actual results to differ materially from current expectations which include, but are not limited to: 1) risk outlined in any prior SEC filings; 2) ability of Syntec Optics to successfully increase market penetration into its target markets; 3) the addressable markets that Syntec Optics intends to target do not grow as expected; 4) the loss of any key executives; 5) the loss of any relationships with key suppliers including suppliers abroad; 6) the loss of any relationships with key customers; 7) the inability to protect Syntec Optics’ patents and other intellectual property; 8) the failure to successfully execute manufacturing of announced products in a timely manner or at all, or to scale to mass production; 9) costs related to any further business combination; 10) changes in applicable laws or regulations; 11) the possibility that Syntec Optics may be adversely affected by other economic, business and/or competitive factors; 12) Syntec Optics’ estimates of its growth and projected financial results for the future and meeting or satisfying the underlying assumptions with respect thereto; 13) the impact of any pandemic, including any mutations or variants thereof and the Russian/Ukrainian or Israeli conflict, and any resulting effect on business and financial conditions; 14) inability to complete any investments or borrowings in connection with any organic or inorganic growth; 15) the potential for events or circumstances that result in Syntec Optics’ failure to timely achieve the anticipated benefits of Syntec Optics’ customer arrangements; and 16) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in prior SEC filings including registration statement on Form S-4 filed with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Syntec Optics does not give any assurance that Syntec Optics will achieve its expected results. Syntec Optics does not undertake any duty to update these forward-looking statements except as otherwise required by law.

For further information, please contact:

Investor Relations

InvestorRelations@syntecoptics.com

SOURCE: Syntec Optics Holdings, Inc. (Nasdaq: OPTX)

SYNTEC OPTICS HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2024 AND 2023

| 2024 | 2023 | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 598,787 | $ | 2,158,245 | ||||

| Accounts Receivable, Net | 5,739,205 | 6,800,064 | ||||||

| Inventory | 6,953,278 | 5,834,109 | ||||||

| Prepaid Expenses and Other Assets | 596,589 | 359,443 | ||||||

| Income Tax Receivable | 9,794 | - | ||||||

| Total Current Assets | 13,897,653 | 15,151,861 | ||||||

| Property and Equipment, Net | 11,668,859 | 11,101,052 | ||||||

| Intangible Assets, Net | - | 295,000 | ||||||

| Deferred Tax Asset | 439,942 | - | ||||||

| Total Assets | $ | 26,006,454 | $ | 26,547,913 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts Payable | $ | 2,706,392 | $ | 3,042,315 | ||||

| Accrued Expenses | 814,600 | 1,071,256 | ||||||

| Federal Income Tax Payable | - | 370,206 | ||||||

| Deferred Revenue | 36,512 | - | ||||||

| Line of Credit | 6,263,863 | 6,537,592 | ||||||

| Current Maturities of Debt Obligations | 467,742 | 362,972 | ||||||

| Current Maturities of Finance Lease Obligations | 284,002 | - | ||||||

| Total Current Liabilities | 10,573,111 | 11,384,341 | ||||||

| Long-Term Liabilities | ||||||||

| Long-Term Debt Obligations | 2,614,812 | 2,024,939 | ||||||

| Long-Term Finance Lease Obligations | 1,784,449 | - | ||||||

| Deferred Income Tax | - | 74,890 | ||||||

| Total Long-Term Liabilities | 4,399,261 | 2,099,829 | ||||||

| Total Liabilities | 14,972,372 | 13,484,170 | ||||||

| Commitments and Contingencies | - | - | ||||||

| Stockholder’s Equity | ||||||||

| CL A Common Stock, Par value $.0001 per share; 121,000,000 authorized; 36,688,266 issued and outstanding as of December 31, 2024; 36,688,266 issued and outstanding as of December 31, 2023 | 3,669 | 3,669 | ||||||

| Common Stock Value | 3,669 | 3,669 | ||||||

| Additional Paid-In Capital | 2,377,204 | 1,927,204 | ||||||

| Retained Earnings | 8,653,209 | 11,132,870 | ||||||

| Total Stockholder’s Equity | 11,034,082 | 13,063,743 | ||||||

| Total Liabilities and Stockholder’s Equity | $ | 26,006,454 | $ | 26,547,913 | ||||

SYNTEC OPTICS HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

| 2024 | 2023 | |||||||

| Net Sales | $ | 28,449,941 | $ | 29,441,180 | ||||

| Cost of Goods Sold | 22,747,615 | 21,520,189 | ||||||

| Gross Profit | 5,702,326 | 7,920,991 | ||||||

| General and Administrative Expenses | 8,278,720 | 6,379,879 | ||||||

| Income (Loss) from Operations | (2,576,394 | ) | 1,541,112 | |||||

| Other Income (Expense) | ||||||||

| Other Income | 346,835 | 370,914 | ||||||

| Interest Expense, Including Amortization of Debt Issuance Costs | (764,934 | ) | (654,765 | ) | ||||

| Total Other (Expense) | (418,099 | ) | (283,851 | ) | ||||

| (Loss) Income Before Provision for (Benefit) Income Taxes | (2,994,493 | ) | 1,257,261 | |||||

| Provision (Benefit) for Income Taxes | (514,832 | ) | (719,172 | ) | ||||

| Net Income (Loss) | $ | (2,479,661 | ) | $ | 1,976,433 | |||

| Net Income (Loss) per Common Share | ||||||||

| Basic and diluted | $ | (0.07 | ) | $ | 0.06 | |||

| Weighted Average Number of Common Shares Outstanding | ||||||||

| Basic and diluted | 36,688,266 | 32,366,725 | ||||||

SYNTEC OPTICS HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

| 2024 | 2023 | |||||||

| Cash Flows From Operating Activities | ||||||||

| Net (Loss) Income | $ | (2,479,661 | ) | $ | 1,976,433 | |||

| Adjustments to Reconcile (Loss) Income to Net Cash (Used In) | ||||||||

| Provided By Operating Activities: | ||||||||

| Adjustments to Reconcile (Loss) Income to Net Cash (Used In) Provided By Operating Activities: | ||||||||

| Depreciation and Amortization | 2,765,713 | 2,769,284 | ||||||

| Amortization of Debt Issuance Costs | 15,057 | 12,451 | ||||||

| Stock-Based Compensation | 450,000 | - | ||||||

| Grant Revenue Income | - | (300,000 | ) | |||||

| Gain on Disposal of Property and Equipment | (309,000 | ) | - | |||||

| Change in Allowance for Expected Credit Losses | (121,767 | ) | (25,820 | ) | ||||

| Change in Reserve for Obsolescence | 186,285 | 124,911 | ||||||

| Deferred Income Taxes | (514,832 | ) | (1,199,214 | ) | ||||

| (Increase) Decrease in: | ||||||||

| Accounts Receivable | 1,182,626 | (848,520 | ) | |||||

| Inventory | (1,305,454 | ) | (2,332,660 | ) | ||||

| Prepaid Expenses and Other Assets | (237,146 | ) | 340,298 | |||||

| Increase (Decrease) in: | ||||||||

| Accounts Payables and Accrued Expenses | (231,163 | ) | 2,493,826 | |||||

| Federal Income Tax Payable | (380,000 | ) | 129,328 | |||||

| Deferred Revenue | 36,512 | (348,095 | ) | |||||

| Net Cash (Used In) Provided By Operating Activities | (942,830 | ) | 2,792,222 | |||||

| Cash Flows From Investing Activities | ||||||||

| Purchases of Property and Equipment | (1,239,866 | ) | (1,921,181 | ) | ||||

| Proceeds from Disposal of Property and Equipment | 309,000 | - | ||||||

| Net Cash Used in Investing Activities | (930,866 | ) | (1,921,181 | ) | ||||

| Cash Flows From Financing Activities | ||||||||

| (Repayments) Borrowing on Line of Credit, Net | (273,729 | ) | 137,592 | |||||

| Borrowing on Debt Obligations | 1,100,388 | 1,745,573 | ||||||

| Repayments on Debt Obligations | (420,802 | ) | (2,908,502 | ) | ||||

| Repayments on Finance Lease Obligations | (91,619 | ) | - | |||||

| Cash proceeds from OLIT | - | 45,946 | ||||||

| Net proceeds from OLIT Trust | - | 1,802,479 | ||||||

| Distributions | - | (62,065 | ) | |||||

| Net Cash Provided By Financing Activities | 314,238 | 761,023 | ||||||

| Net Decrease in Cash | (1,559,458 | ) | 1,632,064 | |||||

| Cash - Beginning | 2,158,245 | 526,182 | ||||||

| Cash - Ending | $ | 598,787 | $ | 2,158,245 | ||||

| Supplemental Cash Flow Disclosures: | ||||||||

| Cash Paid for Interest | $ | 738,010 | $ | 652,778 | ||||

| Cash Paid for Taxes | $ | 568,143 | $ | 283,561 | ||||

| Supplemental Disclosures of Non-Cash Investing Activities: | ||||||||

| Assets Acquired and Included in Accounts Payable and Accrued Expenses | $ | 198,584 | $ | 642,547 | ||||

| Issuance of finance lease for acquisition of equipment | $ | 2,160,070 | $ | - | ||||

| De-recognition of PPE and Intangible Asset transaction | $ | 560,000 | $ | - | ||||

NON-GAAP RECONCILIATION OF EBITDA

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

| 2024 | 2023 | |||||||

| Net (Loss) Income | $ | (2,479,661 | ) | $ | 1,976,433 | |||

| Stock-Based Compensation expense | 450,000 | - | ||||||

| Depreciation & Amortization | 2,765,713 | 2,769,284 | ||||||

| Amortization of Debt Issuance Costs | 9,222 | 12,451 | ||||||

| Interest Expenses | 738,010 | 642,314 | ||||||

| Taxes | (514,832 | ) | (719,172 | ) | ||||

| Non-Recurring Items | ||||||||

| Anomalous Executive Transition expenses | 379,389 | - | ||||||

| Nonrecurring professional Fees | 174,500 | - | ||||||

| Technology Start-up Costs | 344,496 | - | ||||||

| Optical Molding Evaluation Expenses | 201,908 | - | ||||||

| Glass Molding Evaluation Expenses | 130,196 | - | ||||||

| Sale of Equipment & Accessories | - | (10,068 | ) | |||||

| Transaction Filing Fees | - | 344,752 | ||||||

| Management Fees & Expenses | - | 318,334 | ||||||

| Adjusted EBITDA | $ | 2,198,941 | $ | 5,334,328 | ||||

SYNTEC OPTICS HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

JUNE 30, 2025 AND DECEMBER 31, 2024

| 2025 (unaudited) |

2024 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 287,085 | $ | 598,787 | ||||

| Accounts Receivable, Net | 6,038,305 | 5,739,205 | ||||||

| Inventory | 7,992,617 | 6,953,278 | ||||||

| Income Tax Receivable | - | 9,794 | ||||||

| Prepaid Expenses and Other Assets | 321,301 | 596,589 | ||||||

| Total Current Assets | 14,639,308 | 13,897,653 | ||||||

| Property and Equipment, Net | 10,385,435 | 11,668,859 | ||||||

| Deferred Tax Asset | 270,360 | 439,942 | ||||||

| Total Assets | $ | 25,295,103 | $ | 26,006,454 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts Payable | $ | 1,854,077 | $ | 2,706,392 | ||||

| Accrued Expenses | 821,676 | 814,600 | ||||||

| Deferred Revenue | 33,993 | 36,512 | ||||||

| Line of Credit | 6,763,863 | 6,263,863 | ||||||

| Current Maturities of Debt Obligations | 482,973 | 467,742 | ||||||

| Current Maturities of Finance Lease Obligations | 340,492 | 284,002 | ||||||

| Total Current Liabilities | 10,297,074 | 10,573,111 | ||||||

| Long-Term Liabilities | ||||||||

| Long-Term Debt Obligations | 2,372,985 | 2,614,812 | ||||||

| Long-Term Finance Lease Obligations | 1,611,218 | 1,784,449 | ||||||

| Total Long-Term Liabilities | 3,984,203 | 4,399,261 | ||||||

| Total Liabilities | 14,281,277 | 14,972,372 | ||||||

| Commitments and Contingencies | - | - | ||||||

| Stockholders’ Equity | ||||||||

| CL A Common Stock, Par value $.0001 per share; 121,000,000 authorized; 36,920,226 issued and outstanding as of June 30, 2025; 36,688,266 issued and outstanding as of December 31, 2024; | 3,692 | 3,669 | ||||||

| Common stock value | 3,692 | 3,669 | ||||||

| Additional Paid-In Capital | 2,377,181 | 2,377,204 | ||||||

| Retained Earnings | 8,632,953 | 8,653,209 | ||||||

| Total Stockholders’ Equity | 11,013,826 | 11,034,082 | ||||||

| Total Liabilities and Stockholders’ Equity | 25,295,103 | 26,006,454 | ||||||

SYNTEC OPTICS HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||

| Net Sales | $ | 6,559,455 | $ | 7,006,000 | $ | 13,628,497 | $ | 13,261,908 | ||||||||

| Cost of Goods Sold | 4,961,489 | 4,831,673 | 9,721,913 | 10,380,138 | ||||||||||||

| Gross Profit | 1,597,966 | 2,174,327 | 3,906,584 | 2,881,770 | ||||||||||||

| General and Administrative Expenses | 1,744,216 | 2,015,783 | 3,524,382 | 4,130,326 | ||||||||||||

| Income (Loss) from Operations | (146,250 | ) | 158,544 | 382,202 | (1,248,556 | ) | ||||||||||

| Other Income (Expense) | ||||||||||||||||

| Interest Expense, Including Amortization of Debt Issuance Costs | (208,969 | ) | (167,242 | ) | (409,865 | ) | (327,109 | ) | ||||||||

| Other Income | 11,298 | 319,623 | 16,995 | 338,972 | ||||||||||||

| Total Other (Expense) | (197,671 | ) | 152,381 | (392,870 | ) | 11,863 | ||||||||||

| Income (Loss) Before Provision for (Benefit) Income Taxes | (343,921 | ) | 310,925 | (10,668 | ) | (1,236,693 | ) | |||||||||

| Provision (Benefit) for Income Taxes | - | 29,082 | 9,588 | (309,393 | ) | |||||||||||

| Net (Loss) Income | $ | (343,921 | ) | $ | 281,843 | $ | (20,256 | ) | $ | (927,300 | ) | |||||

| Net Income (Loss) per Common Share | ||||||||||||||||

| Basic and diluted | $ | (0.01 | ) | $ | 0.01 | $ | (0.00 | ) | $ | (0.03 | ) | |||||

| Weighted Average Number of Common Shares Outstanding | ||||||||||||||||

| Basic and diluted | 36,920,226 | 36,688,266 | 36,920,226 | 36,688,266 | ||||||||||||

SYNTEC OPTICS HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2025 AND 2024

| 2025 | 2024 | |||||||

| Cash Flows From Operating Activities | ||||||||

| Net Loss | $ | (20,256 | ) | $ | (927,300 | ) | ||

| Adjustments to Reconcile Loss to Net Cash (Used In) | ||||||||

| Provided By Operating Activities: | ||||||||

| Adjustments to Reconcile (Loss) Income to Net Cash (Used In) Provided By Operating Activities: | ||||||||

| Depreciation and Amortization | 1,387,427 | 1,385,606 | ||||||

| Amortization of Debt Issuance Costs | 4,834 | 4,387 | ||||||

| Gain on Disposal of Property and Equipment | - | (309,000 | ) | |||||

| Change in Allowance for Expected Credit Losses | 75,727 | (24,395 | ) | |||||

| Change in Reserve for Obsolescence | (18,881 | ) | 291,576 | |||||

| Deferred Income Taxes | - | (357,994 | ) | |||||

| (Increase) Decrease in: | ||||||||

| Accounts Receivable | (374,827 | ) | 885,368 | |||||

| Inventory | (1,020,458 | ) | (1,958,557 | ) | ||||

| Decrease in Federal Income Tax Receivable | 179,376 | - | ||||||

| Prepaid Expenses and Other Assets | 275,288 | 57,309 | ||||||

| Increase (Decrease) in: | ||||||||

| Accounts Payables and Accrued Expenses | (344,470 | ) | (993,406 | ) | ||||

| Federal Income Tax Payable | - | (318,240 | ) | |||||

| Deferred Revenue | (2,519 | ) | 280,763 | |||||

| Net Cash Provided By (Used In) Operating Activities | 141,241 | (1,983,883 | ) | |||||

| Cash Flows From Investing Activities | ||||||||

| Purchases of Property and Equipment | (604,772 | ) | (254,767 | ) | ||||

| Proceeds from Disposal of Property and Equipment | - | 309,000 | ||||||

| Net Cash (Used in) Provided in Investing Activities | (604,772 | ) | 54,233 | |||||

| Cash Flows From Financing Activities | ||||||||

| (Repayments) Borrowing on Line of Credit, Net | 500,000 | (273,729 | ) | |||||

| Borrowing on Debt Obligations | - | 1,100,388 | ||||||

| Repayments on Debt Obligations | (231,430 | ) | (224,775 | ) | ||||

| Repayments on Finance Lease Obligations | (116,741 | ) | - | |||||

| Net Cash Provided By Financing Activities | 151,829 | 601,884 | ||||||

| Net Decrease in Cash | (311,702 | ) | (1,327,766 | ) | ||||

| Cash - Beginning | 598,787 | 2,158,245 | ||||||

| Cash - Ending | $ | 287,085 | $ | 830,479 | ||||

| Supplemental Cash Flow Disclosures: | ||||||||

| Cash Paid for Interest | $ | 409,579 | $ | 276,809 | ||||

| Cash Paid for Taxes | $ | - | $ | 537,510 | ||||

| Supplemental Disclosures of Non-Cash Investing Activities: | ||||||||

| Assets Acquired and Included in Accounts Payable and Accrued Expenses | $ | 40,362 | $ | 651,736 | ||||

| Issuance of restricted stock from stock-based compensation | $ | 23 | $ | - | ||||

NON-GAAP RECONCILIATION OF EBITDA

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||

| Net (Loss) Income | $ | (343,921 | ) | $ | 281,843 | $ | (20,256 | ) | $ | (927,300 | ) | |||||

| Depreciation & Amortization | 676,623 | 692,194 | 1,387,427 | 1,389,993 | ||||||||||||

| Debt Issuance Costs | 2,418 | - | 4,834 | - | ||||||||||||

| Interest Expenses | 207,623 | 164,828 | 409,579 | 322,722 | ||||||||||||

| Taxes | - | 29,082 | 9,588 | (309,393 | ) | |||||||||||

| Non-Recurring Items | ||||||||||||||||

| Executive Transition | 135,246 | - | 249,189 | - | ||||||||||||

| One time Contract exit costs | 11,750 | - | 21,063 | - | ||||||||||||

| Non-recurring property damage | - | - | 21,261 | - | ||||||||||||

| Professional & Transaction Fees | - | - | - | 25,265 | ||||||||||||

| Technology Start-up Costs | - | - | - | 165,034 | ||||||||||||

| Optical Molding Evaluation Expenses | - | - | - | 38,104 | ||||||||||||

| Glass Molding Evaluation Expenses | - | - | - | 68,392 | ||||||||||||

| Adjusted EBITDA | $ | 689,739 | $ | 1,167,947 | $ | 2,082,685 | $ | 772,817 | ||||||||

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.