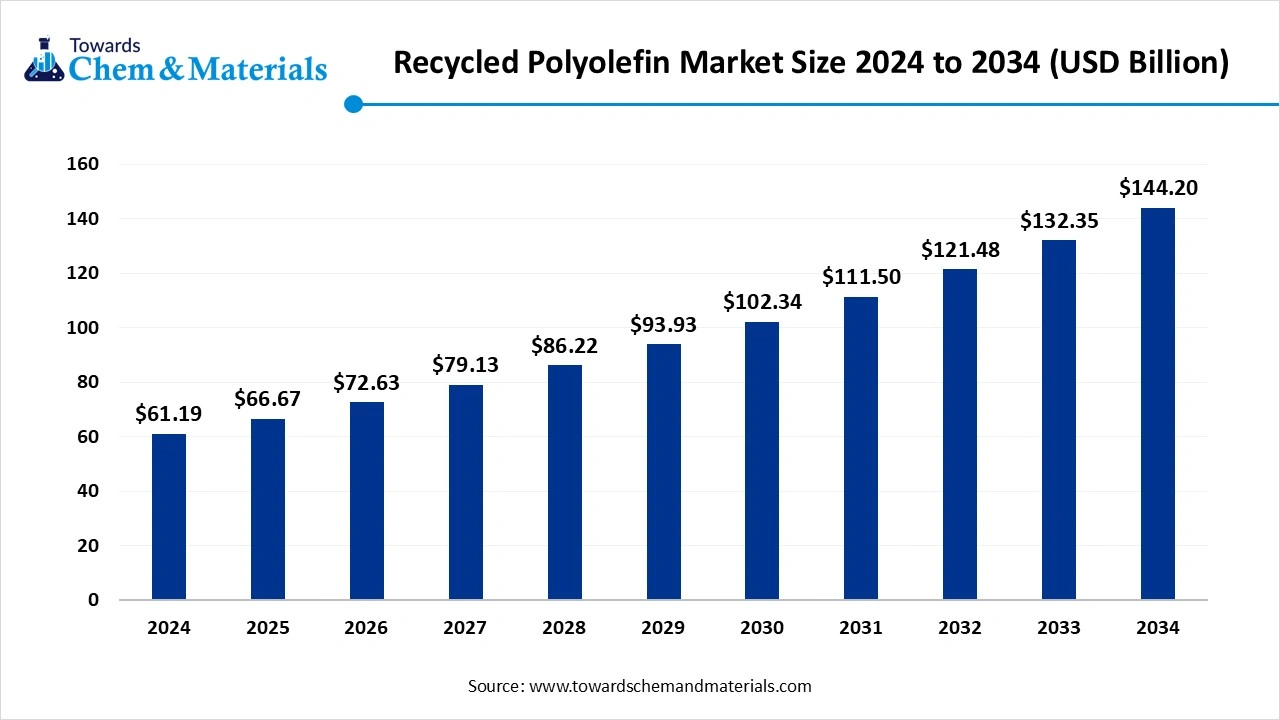

Recycled Polyolefin Market Size to Exceed USD 144.2 Billion by 2034

According to Towards chem and Materials consultants, the global recycled polyolefin market size was reached at USD 61.19 billion in 2024 and is expected to exceed around USD 144.2 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.95% over the forecast period from 2025 to 2034.

Ottawa, July 18, 2025 (GLOBE NEWSWIRE) -- The global recycled polyolefin market size is estimated at USD 66.67 billion in 2025 and is expected to hit around USD 144.2 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.95% over the forecast period from 2025 to 2034. A study published by Towards chem and Materials a sister firm of Precedence Research.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5646

The market is experiencing significant expansion due to the movement to sustainable packaging, light weight automotive, increasing infrastructure and conversion to more recyclable polymer-based solutions.

Recycled polyolefins are merely reused thermoplastics that include polyethylene (PE) and polypropylene (PP) which have been recovered from post-consumer or post-industrial plastics waste and processed for re-use. The properties of recycled polyolefins that provide them desirability i.e., durability, lightweight, and chemical resistance make them suitable for applications in packaging, automotive, and construction.

The market has continued to grow with more environmental considerations, government mandates, and growing consumer, brand owner, and retailer demand for sustainable solutions. Improvements in related sorting technologies and recycling technologies have continued to improve the end usage quality of recycled polyolefins.

Key Takeaways

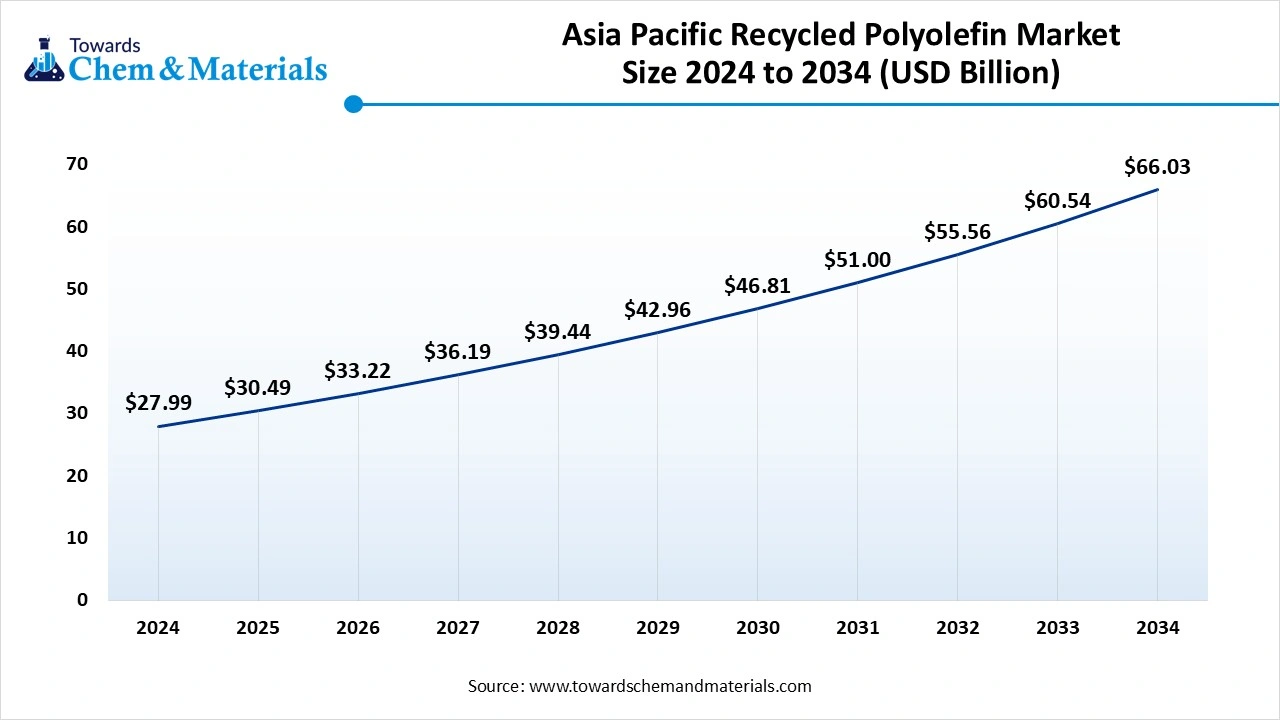

- The Asia Pacific recycled polyolefin market dominated the global market and accounted for the largest revenue share of 45.74% in 2024.

- The Europe is expected to grow at a notable rate in the future, owing to newly implemented and strong environmental standards and regulations.

- By product type, the Low-density polyethylene (LDPE) dominated the recycled polyolefin market across the product type segmentation in terms of revenue, accounting for a market share of 35.38% in 2024.

- By product type, the polyethylene terephthalate (PET) segment is anticipated to grow at a significant CAGR of 9.75% through the forecast period.

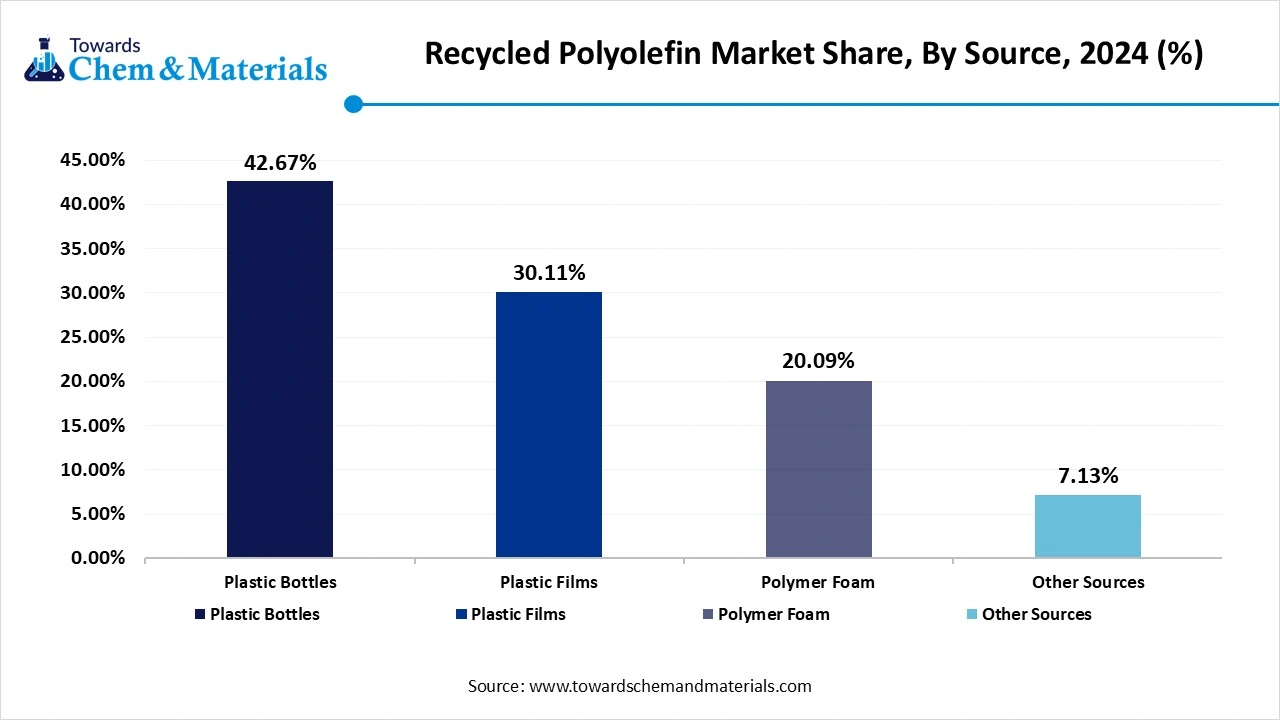

- By source type, the Plastic bottles dominated the recycled polyolefin market across the source segmentation in terms of revenue, accounting for a market share of 42.67% in 2024.

- By source type, the plastic film segment is projected to witness a substantial CAGR of 8.66% through the forecast period.

- By application, the Food packaging dominated the recycled polyolefin market across the source segmentation in terms of revenue, accounting for a market share of 37.64% in 2024.

- By application, the automotive segment is anticipated to grow at a significant CAGR of 9.25% through the forecast period.

Recycled Polyolefin Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 66.67 billion |

| Revenue forecast in 2034 | USD 144.2 billion |

| Growth rate | CAGR of 8.95% from 2024 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2019 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2034 |

| Segments covered | Product type, source, application, region |

| Key companies profiled | LyondellBasell; SABIC; Dow; INEOS; Borealis; GCR; Omya International AG; Pashupati Group |

Explore Strategic Figures & Forecasts – Access the Databook | Immediate Delivery Available: https://www.towardschemandmaterials.com/download-databook/5646

Recycled Polyolefin Market Major Trends

- Utilizing new recycling processes- There is a gradual movement from traditional mechanical recycling to advanced chemical recycling. New innovations that lead to higher-quality output are allowing for recycled polyolefins that meet higher performance and safety standards in packaging and automotive applications.

- Increased demand due to brand commitments to circular economy- Manufacturers and consumer brands are increasing their use of recycled content to meet their sustainability goals, driving demand for recycled polyolefins used in rigid packaging, household goods, and textiles.

-

Development of collection and sorting systems- Governments and the private sector are investing in better waste collection. Newer sorting technologies as well as improved collection systems are increasing both the volume and quality of recycled polyolefins available into the supply chain.

Recycled Polyolefin Market Dynamics

Growth Factor

Mandatory Minimum Recycled-Content Laws Strengthening Demand

Governments are promoting recycled polyolefin adoption, with recycled-content mandates making it law and enforceable. In June 2025, India, released draft Plastic Waste Management (Second Amendment) Rules, require the Category I rigid plastic packaging to have a minimum of 30% recycled content in 2025-26, with targets to reach 60% in 2028-29.

In the USA, California’s Assembly Bill (AB) 793 mandates recycled content standards for plastic beverage containers to contain 25% PCR (post-consumer resin) content in 2025 and must reach 50% by 2030.

These governments provided mandates create un-assessable demand for recycled HDPE and PP, which means packaging producers and resin suppliers can use this buying behavior to take risks, invest in scalable polyolefin recycling infrastructure and material supply, even without market-research summaries.

Is Artificial Intelligence the key to High-Purity and Scalable Recycled Polyolefin Solution?

Artificial Intelligence is beginning to bring higher levels of efficiency and quality into the recycled polyolefin market. India-based Ishitva Robotics is leading in AI-powered waste sorting using NIR and machine learning methods to identify HDPE, LDPE, and PP from mixed waste streams accurately. Their AI- powered "SmaRT" sorters guarantee high purity output, crucial when re-processing into food-grade or industrial-grade recycled polymers.

Europe is home to one of the largest organizations working on a similar project, involving an AI- powered robotic solution called, OMNI, provided by Recycleye and Valorplast, which has been capable of recovering food-grade PP with over 95% purity.

Multinational firms like Borealis and TotalEnergies will be investing in AI-based systems to enhance sorting, traceability and end-product quality to continue to bridge the gap to virgin-grade standards and build the role of recycled polyolefins in the circular economy.

Market Opportunity

Is Heightened Demand for Sustainable Packaging Creating New Opportunities in the Recycled Polyolefin Segment?

One main opportunity for the recycled polyolefin segment is the growing demand for sustainable packaging found in sectors like food & beverage, personal care, and even e-commerce. With environmental concerns building and regulations being enacted for recycled packaging content, many companies are hoping to move away from virgin plastics. For example, Unilever and PepsiCo have recently committed to incorporating more post-consumer recycled polyolefin in their product packaging.

The EU directive of single use plastics and somewhere like India has also moved to amend its Plastic Waste Management Rules to focus on single-use plastics accelerating uptake of recycled polyolefin. Consumer awareness is surging so brands are also taking it seriously to meet their circular economic goals. All of this is helpful for recycled polyolefins as a valuable material in the world as we transition to greener packaging alternatives.

What can be the Potential Barriers Limiting the Future Growth of Recycled Polyolefin Market?

- Variable quality of recycled materials- Recycled polyolefins frequently have consistency problems because of contamination; physical degradation during processing; and mixed plastic waste streams. These issues often impede the use of recycled polyolefins in high-end or technical applications.

- Lack of collection and sorting infrastructure- Inefficient waste collection systems and inadequate sorting infrastructure, particularly in developing countries, prevent the separation and accessibility of clean polyolefin waste, thus not providing a suitable, economically viable waste stream for polyolefins, and inhibit market growth.

-

Regulatory and food safety issues- Due to strict regulations and food contact safety standards, food-grade and medical medical-grade applications for polyolefins are severely restricted, thus limiting re-use and recycling of polyolefins for commercial purposes, to those select industries.

Invest in Premium Global Insights Immediate Delivery Available @ https://www.towardschemandmaterials.com/price/5646

Recycled Polyolefin Market Segmentation Analysis

Product Analysis

Which Product Segment Will Take the Dominated in the Recycled Polyolefin Market Landscape?

Low-Density Polyethylene (LDPE) segment is leading recycled polyolefin market in 2024, because of its useful application in films and packaging. Its properties provide recyclability, consumer preference for flexibility and low cost, and the source of commonly found waste (i.e., recyclable plastic bags), making it a favourite among manufacturers for cost neutral and sustainable means of using recycled materials.

Polyethylene Terephthalate (PET) segment expects the fastest growth in the market during the forecast period, due to its recyclable nature and increasing segments of application (packaging and textiles). With the increased use of chemical recycling, PET recovery rates have improved and supported sustainability goals and compliance with regulations which is hastening its adoption in various consumer and industrial applications.

Source Analysis

Why Does Plastic Bottles Segment Dominated the Recycled Polyolefin Market in 2024?

Plastic bottles segment dominated the recycled polyolefin market in 2024, because they are the most widely consumed type of plastic item and possess the best collection system. In addition, plastic bottles are the source stream that is the easiest to sort and process, and we can get a reliable and sustainable source of high-grade recycled raw material for packaging and household and industrial products.

The plastic film segment expects the fastest growth in the market during upcoming period, because there has been an increase in recycling programs for agricultural films, carrier bags, and flexible packaging wraps. Improvements in the technology used to sort film, and there are new compliance regulations forcing industry to manage flexible plastic waste which adds additional pressure on recyclers to find a solution for the large stream of material that is not recyclable for the time being.

Application Analysis

Which Application Segment Holds the Dominant Share of Recycled Polyolefin Market?

Food packaging segment leads the recycled polyolefin market in 2024, due to an increasing demand for sustainable options in consumer goods. Recycled polyolefins provide safety, flexibility, and durability, which make them great choices for packaging trays, containers, and films, as food brands transition to sustainable packaging options.

The automotive segment expects the fastest growth in the market during the forecast period, as manufacturers seek lightweight, cost effective, and environmentally friendly materials. Recycled polyolefins find uses in non-structural and a variety of components like interior trim, under body shields, and battery housings, in support of circular economy strategies and compliance with vehicle sustainability requirements.

Regional Analysis

The Asia Pacific recycled polyolefin market is expected to increase from USD 30.49 billion in 2025 to USD 66.03 billion by 2034, growing at a CAGR of 8.96% throughout the forecast period from 2025 to 2034.

Why is Asia Pacific dominating the Global Recycled Polyolefin Market?

Asia Pacific dominated the market in 2024, due to the wide industrial base, industrial development and demand from the construction and automotive industries. There are strong governmental incentives in Asia Pacific to reduce plastic waste and improve recycling infrastructure. For example, the Swachh Bharat Mission is helping India improve access to and quality of recycling, and limiting the amount of waste that can be imported into China is pushing its industries to develop and support domestic recycling efforts. The increasing consumption of plastics in areas such as automotive, construction, and fast-moving consumer goods (FMCG) also supports using recycled polyolefins as an input for many of these types of industrial applications.

China Market Trends

China is the leading country in the Asia Pacific recycled polyolefin market, driven by strong industrial development and demand for polyolefin in China from industries such as automotive, food and beverage packaging. The country is quickly growing its domestic recycling capacity, driven by demand from electric vehicles and e-commerce. In 2024, China imported 2.4 million tons of PE from the U.S. This accounted for 20% of its China’s PE imports.

Additionally, the adoption of technology, including sorting solutions powered by artificial intelligence, is positioning China to be an important leader in both regulatory action and innovation.

What Makes Europe the Fastest Growing Marketplace for Recycled Polyolefin Market?

Europe expects the fastest growth in the market during the forecast period, due to stringent environmental legislation, heightened consumer awareness, and a robust commitment to circular economy principles. Demand, from packaging and industrial applications, is set to be boosted by the EU’s Single-Use Plastics Directive, alongside prescribed mandates on recycled content. Furthermore, there has been considerable progress with respect to technological innovation in mechanical and chemical recycling across the region. Several nations are opting to provide subsidies or incentives to improve the operations of plastic collection and sorting.

-

In October 2024 - ICIS published new pricing assessments for recycled polyolefin agglomerates in Europe to enhance transparency and provide value chain stakeholders with reliable price benchmarks to improve decision making in the recycling and manufacturing sectors.

Germany Market Trend

Germany leads within the region from the standpoint of recycling, partly due to an established recycling infrastructure and proactive policy making. Germany has a dual waste collection system, allowing for a higher recovery of polyolefin materials which can be processed into high-quality applications. This leadership position is supported by strong R&D investment and government-backed recycling mandates that are placing Germany firmly ahead in the renewable polyolefin space within Europe.

More Insights in Towards Chem and Materials:

Polyolefin Market: The global polyolefin market volume was valued at 230.72 million tons in 2024 and is estimated to reach around 371.54 million tons by 2034, exhibiting a compound annual growth rate (CAGR) of 4.88% during the forecast period 2025 to 2034.

Polyvinyl Chloride (PVC) Market : The global polyvinyl chloride (PVC) market size was estimated at USD 86.93 billion in 2024 and is expected to hit around USD 116.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

Polyethylene Terephthalate (PET) Market : The global polyethylene terephthalate (PET) market size was estimated at USD 39.25 billion in 2024 and is predicted to increase from USD 41.47 billion in 2025 to approximately USD 68 billion by 2034, expanding at a CAGR of 5.65% from 2025 to 2034.

Polyethylene Glycol (PEG) Market : The global polyethylene glycol (PEG) market volume was reached at 450,000 tons in 2024 and is expected to be worth around 788,565.1 tons by 2034, growing at a compound annual growth rate (CAGR) of 5.77% over the forecast period 2025 to 2034.

Polyolefin Sheets in Industrial Market: The global polyolefin sheets in industrial market size accounted for USD 8.49 billion in 2024, grew to USD 8.99 billion in 2025, and is expected to be worth around USD 14.99 billion by 2034, poised to grow at a CAGR of 5.85% between 2025 and 2034.

Polymer Denture Material Market : The global polymer denture material market size accounted for USD 2.49 billion in 2025 and is forecasted to hit around USD 4.11 billion by 2034, representing a CAGR of 5.75% from 2025 to 2034.

What Is Going Around The Globe In Recycled Polyolefin Market?

- In October 2024 EREMA presented its new INTAREMA TVEplus Regrind Ro machine for Europe, which advances the recycling of polyolefins by providing higher quality recyclates and greater flexibility in processing contaminated plastic materials efficiently.

- In January 2025, PolyCyclA, the startup based in Chandigarh revealed a revolutionary plastic recycling technology in Bengaluru, leveraging AI for advanced sorting and recovery of polyolefins to reduce dependency on landfills and advance sustainable plastic management.

-

In March 2025, GCR launched a new polyolefin recycling facility in Spain to support the circular economy. The facility features cutting-edge technologies to specifically recycle plastic waste into quality recycled polyolefins to allow for industrial reuse.

Top 10 Companies in Recycled Polyolefin Market & Their Contributions

- LyondellBasell- Developing Europe’s largest advanced plastic recycling hub in Knapsack, Germany to supply feedstock for its Wesseling and Geleen sites; aims to produce 2 million metric tonnes/year of recycled and renewable polymers by 2030.

- SABIC- Under its TRUCIRCLE™ portfolio, SABIC offers mechanical and certified circular polymers via advanced recycling; in India, a MoU with Pashupati Group to process post-consumer plastic into pyrolysis oil for certified circular polyolefins

- Dow- Utilities both mechanical and advanced recycling; offers REVOLOOP™ post-consumer recycled PCR resins, chemical recycling partnerships (Mura, Freepoint, Valoregen) to scale rPO feedstock capacity by 2030

- INEOS- Offers Recycl-IN hybrid polymers mixing PCR with engineered virgin resins (up to 60% PCR content); also developing advanced recycling and “design for recycling” mono-material films

- Borealis- Borcycle™ mechanical & chemical recycling tech converting mixed post-consumer waste into high-quality rPO; acquisitions (mtm, Ecoplast, Integra, Rialti) boosting capacity; demonstration compounding line in Belgium operational mid-2025

- GCR- CICLIC® portfolio of high-quality rHDPE, rLDPE, rLLDPE, rPP produced via mechanical recycling; new Spain plant (Castellet i la Gornal) with 130,000 t/yr capacity; CO₂ savings up to 90%

- Pashupati Group- Indian recycler producing food-grade recycled polyolefin granules (HDPE/PP); exports to 25+ countries; MoU with SABIC for advanced recycling (pyrolysis oil feedstock) and value-added rPO pellets

- Omya International AG- Provides calcium carbonate masterbatch (Omyaloop MIX) to enhance mechanical properties of recycled polyolefin blends (PE/PP); enables broader feedstock acceptance and lower carbon footprint

Recycled Polyolefin Market Top Key Companies:

- LyondellBasell

- SABIC

- Dow

- INEOS

- Borealis

- GCR

- Pashupati Group

- Omya International AG

Recycled Polyolefin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chem and Materials has segmented the global Recycled Polyolefin Market

By Product

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene

- Other Product Types

By Source

- Plastic Bottles

- Plastic Films

- Polymer Foam

- Other Sources

By Application

- Food Packaging

- Construction

- Automotive

- Non-food Packaging

- Other Applications

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5646

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chem and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.